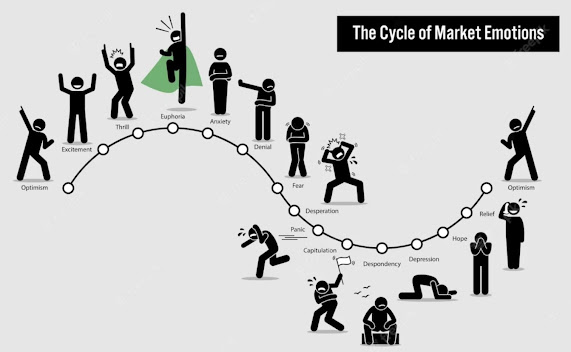

How you may feel during a typical market cycle

Our emotions can be a huge obstacle to our investment success. Emotional investing decisions, like chasing performance or moving into and out of the market, are usually reactions intended to avoid risk. However, they could lead to the biggest risk of all: not reaching your long-term financial goals. Remember, a short-term market decline doesn’t change your long-term goals. It’s important to maintain a long-term perspective and stay invested during the ups and downs. If appropriate, consider investing more in quality investments when prices are down.

Keep emotions out of investing

Following big market declines, you may be tempted to keep your money in short-term investments and

out of the stock market because it seems easier. And while you may think the average consumer

isn’t confident in the economy because the market returns are low, consider the following:

• Historically, when consumer confidence was low, stock prices were also low, and future returns

ultimately tended to be higher.

• On average, stocks returned 14.7% per year following a consumer confidence reading of 66 or lower.

• When consumer confidence was higher, stock prices were higher, and future returns tended to be low, averaging 2.8% per year following consumer confidence readings of 113 or higher.

prohibited without prior permission. The Dow Jones Industrial Average (Dow) is an unmanaged index and is not meant to depict an actual investment.

Figures do not include fees, commissions or expenses, which would have a negative impact on investment results. Consumer Confidence is a survey

conducted by the Conference Board measuring consumer optimism or pessimism with respect to the economy in the near future. The Conference Board

is a not-for-profit research organization for businesses that distributes information about management and the marketplace. It is a widely quoted private

source of business intelligence.